Insurance Jobs

Job Profiles in Insurance

Types of Companies Offering Jobs in

Insurance

Entry Level Job Profiles in Insurance

Public Sector Insurance Companies Jobs

Private Sector Jobs in Insurance

Insurance Jobs in India Important Links

Global Insurance Jobs Important Links

Insurance Jobs in India

have greatly increase in India with the liberalization of the Insurance Sector

and advent of private players. These Job opportunities

are a result of innovative products, better packaging of products, improved

customer service and better trained of employees.

Insurance Jobs in India

have greatly increase in India with the liberalization of the Insurance Sector

and advent of private players. These Job opportunities

are a result of innovative products, better packaging of products, improved

customer service and better trained of employees.

An insurance company today has opening in marketing, distribution,

underwriting, actuarial, operations and investing departments.

Insurance Jobs are available in:

1.

Accounts

2.

Audit and Risk Management

3.

Actuarial

4.

Administration

5.

Business Research

6.

Channel Development

7.

Customer Service

8.

Claims

9.

Group Sales

10.

Legal & Compliance

11.

Marketing

12.

Operations

13.

Sales- Alternate

Channel/Retail/Direct

14.

Underwriting

15.

Quality Management

Insurance Professionals are recruited by:

1.

Public and Private Insurance Companies

2.

Reinsurance Companies

3.

Insurance Brokers

4.

Re-Insurance Brokers

5.

Actuarial firms

6.

Health Insurance Firms

7.

Third Party

Administrators(TPA)

8.

Consulting Firms

9.

Banks

10.

Non-Banking Finance

Companies

11.

Micro Finance Companies

12.

IT Companies

Entry Level Placement in these organizations is as:

1.

Management Trainees

2.

Executive Trainees

3.

Business Analysts

4.

Business Development

Manager

5.

Actuarial Analyst

6.

Insurance Analyst

The type of job which you

get as fresher in the insurance sector Depends both upon the type of the

organization and the education or skills of the applicant. The

job options in insurance in India are

today more varied and require the applicant to possess higher level of skills

and specialized trainings.

The type of job which you

get as fresher in the insurance sector Depends both upon the type of the

organization and the education or skills of the applicant. The

job options in insurance in India are

today more varied and require the applicant to possess higher level of skills

and specialized trainings.

There are two broad streams of insurance –general insurance and life

insurance. Life Insurers transact life insurance business while general Insurers

transact the rest. The Insurance Regulatory and Development Authority (IRDA) is

the regulatory body for the insurance industry in India Some insurance careers

are highly specialised and require relevant specialised qualifications while

others are open to all graduates.

Let us see what these different insurance jobs mean

Actuaries help design plans and evaluate the financial risks a company takes when it

sells an insurance policy or offers a pension plan.

Underwriters assess proposals and determine terms and costs of an insurance policy

before deciding whether to insure a customer.

The underwriter may decide to pass on a part of the risk to another

insurer. This is known as reinsurance.

Reinsurance is an insurance bought by the insurers.

Claims staff work with people to settle claims against their policies. They review the

policy details, and obtain evidence before paying a claim.

Loss assessors or surveyors investigate claims for losses caused by burglaries, thefts,

fires and car accidents, etc. They work out the loss covered by an insurance

policy and report the details and circumstances to the insurer.

Insurance agents work on behalf of insurance companies. They are sales professionals who

collect premiums and meet sales targets on a commission basis.

Insurance Brokers are independent business people who work for themselves or for brokerage

firms to find the best insurance package for their clients’ needs.

Risk Managers identify and assess their company’s risk, advising on insurance and

investment strategies.

PUBLIC SECTOR INSURANCE JOB OPTIONS

PUBLIC SECTOR INSURANCE JOB OPTIONS

The Public Sector insurance industry employs many occupational groups such

as assistant administrative officers in insurance companies, insurance surveyor,

risk managers, underwriters, claim adjusters, actuaries, insurance consultants,

etc.

While LIC provides life insurance, the 4 independent public sector general

insurance companies, namely New India Assurance, National Insurance, Oriental

Insurance & United India Insurance are concerned with non-life insurance like -

motor, marine, fire, health and personal accident insurance

The various posts and

their specific jobs in public sector insurance companies are:

Administrative Officer and

Assistant Administrative Officer

Administrative Officer (AO) and Assistant Administrative Officer (AAO)

belong to the class I officer group. The job begins with the candidates joining

LIC and GIC on a probation-cum-training period of 6 months. This is to provide

exposure about the working of insurance sector. AAOs can choose any of the areas

from Administration, Development and Accounts.

In Administration AAOs handle policy making, policy claims upto certain

limit, checking clauses and details, filing official returns and statements to

higher regional offices etc. The Development AAOs deal with marketing and

procurement of business, promoting policies, getting contracts etc. The Accounts

AAOs manage the funds including incomes and expenses of the corporation. After 3

years of working as AAOs they can be promoted to AOs. This adds on more powers

and authority and they can be posted anywhere in India.

Development Officer

The Development Officer belongs to class II officer group. They are in

charge of their territory for the development of the insurance policies. They

handle recruitment of agents; train them for procurement of new business and

servicing of the existing policies. Over a period of time Agents recruited by

the Development Officers can also rise to the position of the Development

Officer. Recruitment process of Development Officers is handled by the

Divisional Office.

Actuaries

Actuaries help design plans and evaluate the financial risks a company takes when it

sells an insurance policy or offers a pension plan. Public Sector Insurance companies

hire actuaries but these jobs are few and highly paid.

PRIVATE SECTOR INSURANCE

JOBS

There are as many private life insurance companies operating at present in

India (www.irdaindia.org). Private insurers have designations different from

those of LIC & public sector general insurance companies, yet the functions are

more or less similar. The various functions in a private insurance company

(common to those in the public sector) can be summed as follows:

SALES & DISTRIBUTION

Sales function is the main line of function, and at any moment there are

thousands of sales professionals working in insurance companies; their profile

ranging from agents/ advisors to relationship officers/ executives to sales/

relationship managers. Private insurers have coined several designations such as

sales executives/financial planning executives/ relationship executives for

entry level sales jobs to sales managers/ unit managers/ sales development

managers/business managers etc for first level manager’s jobs in sales of

insurance products. Key result areas range from achieving First year premium

targets for entry level executives to recruiting and managing a team of agents

and achieving key sales targets for a sales manager.

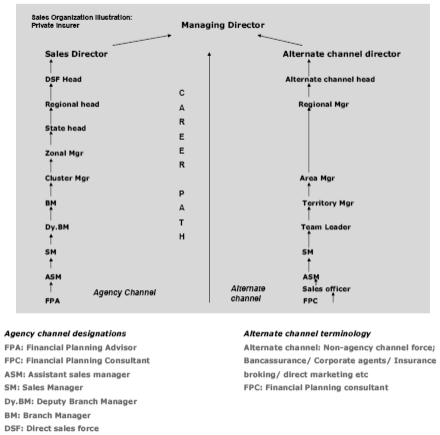

Hierarchy takes you to the branch manager, cluster manager, area manager,

regional manager, zonal manager, and national sales head reporting to the CEO.

The sales manager’s role & function is similar to the development officer’s

role in LIC.

The sales function is

further divided according to channels of distribution. The 2 common channel

funnels are:

1.

The direct agency sales

channel

2.

The Indirect alternate

channel of distribution.

Career

path in the private insurance sector

Sales Career path in a typical private life

insurance company

Direct Agency Sales

Channel:

Agents and agency managers are a part of the direct channel that reports to

the branch sales manager and is responsible for branch sales targets.

Alternate Sales Channel:

The alternate channel comprises of distributors of insurance products that

operate independently from their offices & various sales points; and are

normally not a part of the branch sales business targets. These channels are

also referred to as third party distribution channels. TPD includes banc

assurance tie-ups, corporate agents, insurance brokers, business associates, and

referral arrangements with banks.

IRDA regulates the appointment and working of these intermediaries for the

ensuring the safeguard of consumer’s rights and interests. The Alternate channel

is one of the cost-effective growth strategies of the insurer and many insurers

have tied up with banks and financial institutions to leverage the distribution

strengths of the channel partners & reach out to their captive customers.

Banc assurance:

Banks find the tie-up with insurers beneficial because banks acquire a new

source of revenue and earn substantial first year commissions from insurers for

recommending the co-branded products to their captive clients. Many nationalized

and private sector banks in India have either promoted their own insurance

company or entered into corporate/ referral tie-up with insurers in the life/

general insurance sector. Bancassurance sales professionals employed with

insurers have business targets to be generated through the bank’s offices and

referrals. These sales professionals are referred to as relationship managers

and they in turn organize and manage the entry level sales executives at the

bank’s branches; whose job profile is simple: talk to walk-in customers and

captive bank customers, initiate prospect’s interest in the product and close

the sale. All such closed sales result in achieving premium targets for the

individual and the team. All this may seem simple, however, the job requires

high soft skills, coupled with a high emotional quotient level to sustain the

sales pressure & remain positive on the job.

The same is true for all sales professionals in the insurance industry,

with the exception of the agent/ advisor who; being his own boss, enjoys the

privilege of setting his own time and sales targets. One of the most challenging

functions of the sales manager is to maintain a cordial & challenging

professional relationship with his team of agents on an individual and team

level, since it is the agent who is the wheel of the agency business system.

Salaries in the Sales and Distribution range from 10-15k for entry level

trainee/ executive sales jobs with incentives; to 20-30 k for sales manager; to

40-60k for branch sales managers. Area sales manager get annual CTC in the range

of 8-10 lakhs, while regional sales managers salaries can range from 15-30 lakhs

pa; depending on the experience of the person, the employer, and the person’s

perceived worth to the company.

Thus, there are huge opportunities in the sales function in any insurance

company, to work independently as agents or become employees of the company and

function as sales executives/ managers etc. Sales jobs constitute the majority

in the insurance sector. However, the largest turnover of employees also happens

in the sales department; due to sales pressures, deadlines, and irregular

working hours.

ACTUARIAL

An actuary holds one of the most important position in an insurance

business. He is involved in solving wide range of financial problems related

with insurance investments, financial planning and management. Graduates in

maths or statistics are suited for this kind of a job because the work is based

on mathematical and statistical skills. In the coming times it will definitely

make one of the highly paid career option in the insurance sector. Entry level

salary is expected to be somewhere around Rs. 10 lakh p.a.

The Actuary and his Role

An actuary is always linked, by general impressions, with insurance and his

role to the job of asset liability valuation of insurers. As opined by the

Morris committee of the H.M. Treasury, London, and quoted above, an actuary’s

role, in fact, extends to the whole gamut of the financial systems of any

country, including the effects that the global communities make on them. His job

is managing risk for profit of any firm, of any size. Product Designing, Product

Pricing, Customer Value Management, Risk Management and Capital Management are

the five key elements in the alchemy of an actuary – be it insurance, banking,

fund management, any financial or risk-based organization of private or

government entities.

While most of the developed countries are engaging the so-important

actuarial services to their economic benefits, countries like India are yet to

gear up their ‘economic benefits’ to the actuarial advices. The reasons are many

and the most important one being the dearth of such services. There are not many

amongst the bright and capable graduates and post-graduates from the

universities to take up the qualifying examinations to become actuaries, for the

plausible reason that there are no regular and standard institutions offering

the class-room courses for these examinations.

UNDERWRITING

The life and non-life insurance segments require professional underwriters.

Underwriters assess the risk in the business and take care of risk management.

Normally foreign insurers prefer people with medical or life science background

for this job and the same is likely to happen here. Entry level salary can be

expected to be around 6 lakh p.a.

MARKETING AND DISTRIBUTION

Marketing insurance product is not easy at all. It is like marketing any

other financial product, which requires a push. Marketing therefore would

require specialization. Degree holders from reputed institutes and those with

experience in marketing and finance fields can anticipate bright opportunities

in the insurance sector. Even the role of agents will witness a radical change;

they will moreover serve as financial consultants, who will offer a complete

range of insurance solutions.

OPERATIONS

The insurance sector will be requiring Infotech professionals for elaborate

databases, network solutions and for in house packages etc. Like other sectors,

demand for database and software professionals is expected to grow in the

insurance sector as well.

INVESTMENT

Like banks and mutual funds, investment professionals

will be required in insurance sector as well. Professionals with degree in

finance from reputed institutes as well as experienced professionals from banks

and mutual funds have promising career options to look forward to.

Important Links

Insurance Jobs in India

PNB METLIFE

http://www.pnbmetlife.com/MetLifeCareers_Landing.aspx

United India General Insurance

http://uiic.co.in/careers/recruitment

Naukri Portal Insurance Jobs

http://jobsearch.naukri.com/insurance-jobs

MAX Life Insurance

http://www.maxlifeinsurance.com/careers/careers.aspx

Life Insurance Corporation (LIC)

http://www.licindia.in/careers.htm

TIIMES JOB PORTAL

http://www.timesjobs.com/jobfunction/insurance-jobs

Global Jobs in

Insurance

Allianz

http://www.agcs.allianz.com/careers/

AIG

http://www.aig.com/careers_3171_437777.html

Metlife

https://www.metlife.com/careers/career-areas/insurance-jobs/index.html

ZURICH

http://www.zurich.com/careers/jobsearch.htm

SCOTIA BANK

http://jobs.scotiabank.com/ca/canada/insurance-jobs

NIRA

http://www.insurancerecruiters.com/

INTERNATIONAL INSURANCE JOB PORTAL

http://www.insurancejobs.com/

http://www.indeed.com/q-International-Insurance-jobs.html

http://www.darwinrhodes.com/

http://www.insurancejobs.co.uk/jobs/broking/

http://www.totaljobs.com/JobSeeking/(Insurance%20Company).html

....