DIFFERENCE

BETWEEN CAGR, XIRR AND IRR

Returns have

always been the central standard while going for any investments. These

indicate how much the fund has lost or gained during the particular investment

period. You may come across returns expressed in the variety of nomenclatures.

Have you ever wondered what does each kind of return signify ? or why not use

single kind of return in all types of investments. What is the need to quote

CAGR in lumpsum investment while XIRR in SIP’s. It is the awareness of these

subtle yet significant differences that are going to take your investments to

new heights. The more you get to know the usefulness and application of these

returns, the more good you are going to

feel with your investment reports.

Returns have

always been the central standard while going for any investments. These

indicate how much the fund has lost or gained during the particular investment

period. You may come across returns expressed in the variety of nomenclatures.

Have you ever wondered what does each kind of return signify ? or why not use

single kind of return in all types of investments. What is the need to quote

CAGR in lumpsum investment while XIRR in SIP’s. It is the awareness of these

subtle yet significant differences that are going to take your investments to

new heights. The more you get to know the usefulness and application of these

returns, the more good you are going to

feel with your investment reports.

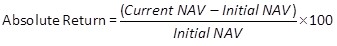

Absolute

Return

It helps you

to calculate the simple returns on your initial investment. What you need is

only the initial and the current or the ending Net Asset value (NAV) of the

scheme. In calculating the point to point or absolute return, the holding time

does not play a role. So if your initial NAV was, say, Rs. 20 and now after 3

years , it is Rs. 40, the point to point return comes to 100 percent.

Formula to

calculate absolute return

This formula is used to calculate returns when the holding period is less than 12 months.

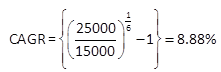

Understanding

CAGR

CAGR stands

for Compounded Annual Growth Rate

The concept

of CAGR is relatively straightforward and requires only three primary inputs:

an investment’s beginning value, ending value and the time period. CAGR is

superior to average returns because it considers the assumption that the

investment is compounded over time.

Advantages

of CAGR

·

CAGR isthe

best formula for evaluating how different investments have performed over time.

·

Investors can

compare the CAGR in order to know how well one stock/mutual fund has performed

against other stocks in a peer group or against- market index.

·

The CAGR can

also be used to compare the historical returns of stocks to bonds or a savings

account.

Disadvantages

of CAGR

·

It ignores

volatility by assuming steady growth rate over the entire investment tenure,

only taking into account an initial and a final value

·

CAGR is also

subject to manipulation as the variable for the time period is input by the

reason calculating it and is not a part of calculation itself.

·

It shows past

performance of the fund as in you should

not expect your investments to grow as per CAGR in future.

·

It does not

consider the interim values and relies only on the ending value and the

beginning value which may again give a wrong picture if you ignore yearly

returns.

CAGR is a way

to smoothen out the returns, it determines an annual growth rate on an

investment whose value has fluctuated from one period to the next. In that

sense, CAGR isn’t the actual return in reality. This is similar to saying that

you went on a trip and averaged 60km/hr. The Whole time you did not actually

travel 60km/hr. Sometimes you were traveling slower, other times faster.

Let us

understand with an example

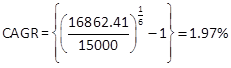

Suppose a

person invested Rs. 15000 in a mutual fund on 1 Jan 12 and redeem it on 1 Jan

18. The value of the investment at the time of redemption was 25000. So here

CAGR (Compounded annual growth return turns out to be)

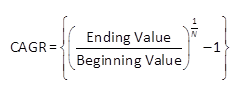

Formula to

calculate CAGR

So,

Here we have

assumed that investment is done only at the beginning and also redeemed only

once. In between these six years, no investmentis made at nothing is redeemed.

So CAGR easily turns out to be 8.88%

But there are

sometimes when investment is not made at lumpsum but made periodically. So at

that time CAGR turns out to be an irrelevant method to calculate return.

Let us understand with an example

Suppose you started mutual fund investment on Jan 1 2012, with

details as follows

|

Date

(A)

|

SIP

Amount

(B)

|

NAV

(C)

|

Units bought

(D) (B/C)

|

NAV on redemption

(E)

|

Holding period (in years)

(F)

|

Value on redemption

(G) (D*E)

|

|

01/01/12

|

15000

|

44.54

|

336.72

|

50.078

|

6

|

16862.41

|

|

30/01/13

|

15000

|

40.44

|

370.87

|

50.078

|

4.92

|

18572.63

|

|

12/05/14

|

15000

|

37.19

|

403.30

|

50.078

|

3.63

|

20196.54

|

|

22/07/15

|

15000

|

41.02

|

365.64

|

50.078

|

2.47

|

18310.50

|

|

01/11/16

|

15000

|

42.98

|

348.98

|

50.078

|

1.16

|

17476.39

|

|

10/10/17

|

15000

|

44.89

|

334.13

|

50.078

|

0.22

|

16732.45

|

Let us first calculate CAGR we got

on our individual investment amount.

So,

And so on for the other SIP’S

|

Date

(A)

|

SIP

Amount

(B)

|

NAV

(C)

|

Units

bought

(D) (B/C)

|

NAV

on redemption

(E)

|

Holding

period (in years)

(F)

|

Value

on redemption

(G) (D*E)

|

CAGR

on individual

Investment

|

|

01/01/12

|

15000

|

44.54

|

336.72

|

50.078

|

6

|

16862.41

|

1.97%

|

|

30/01/13

|

15000

|

40.44

|

370.87

|

50.078

|

4.92

|

18572.63

|

4.44%

|

|

12/05/14

|

15000

|

37.19

|

403.30

|

50.078

|

3.63

|

20196.54

|

8.54%

|

|

22/07/15

|

15000

|

41.02

|

365.64

|

50.078

|

2.47

|

18310.50

|

8.40%

|

|

01/11/16

|

15000

|

42.98

|

348.98

|

50.078

|

1.16

|

17476.39

|

14.07%

|

|

10/10/17

|

15000

|

44.89

|

334.13

|

50.078

|

0.22

|

16732.45

|

64.34%

|

|

|

|

|

|

|

|

108150.93

|

|

In this way, we can calculate CAGR for each of our investment.

But some people might be interested inthe total CAGR got on the

total investment made instead of CAGR on the individual investment.

|

Incorrect

Approach

|

Correct

Approach

|

|

Total investment made = 90,000

Redemption value = 108150.93

Time period = 6

Return :

{108150.93/90000)^(1/6)}-1

= 3.10%

|

Calculation of IRR (Internal

rate of return) in case of consistent cash flows

Calculation of XIRR (Extended

Internal rate of return) in case of inconsistent cash flows

|

Here, taking the same example we

can see Investment is made at irregular intervals. So the correct approach to

calculate return in this type of situation is XIRR .

Let us try to learn the concept of

XIRR in detail.

What is

the meaning of XIRR

XIRR stands

for Extended internal rate of return

XIRR is a

method used to calculate returns on investments where there are multiple

transactions happening at different times. It is a good function to calculate

returns when your cash flows(investments or redemption)are spread over a period

of time. In the case of Mutual funds,if you are investing through SIP or

lumpsum or redeeming through SWP or lumpsum , XIRR can take care of all those

scenarios and helps you calculate a consolidated return considering timings of

your investment and withdrawals.

XIRR is a

method used to calculate returns on investments where there are multiple

transactions happening at different times. It is a good function to calculate

returns when your cash flows(investments or redemption)are spread over a period

of time. In the case of Mutual funds,if you are investing through SIP or

lumpsum or redeeming through SWP or lumpsum , XIRR can take care of all those

scenarios and helps you calculate a consolidated return considering timings of

your investment and withdrawals.

You can think

of XIRR as nothing but an aggregation of multiple CAGR’s. If you make multiple

investments in a fund, you can use the XIRR formula to calculate your overall

CAGR for all those investments taken together.

XIRR Function

Errors

If you get an error from the Excel XIRR function this is likely to

be one of the following

|

Common

Errors

|

|

#NUM!

|

Occurs if Either

:

|

|

|

·

The

supplied values and dates arrays have different lengths

|

|

|

·

The supplied

values array does not contain atleast one negative and at least one positive

value

|

|

|

·

Any of the

supplied dates precedes the first supplied date

|

|

|

·

The

calculation fails to converge after 100 iterations

|

|

#VALUE!

|

Occurs if any of the supplied dates can’t be recognized as valid

excel dates

|

What is

IRR Approach

The IRR

approach is a guideline for evaluating whether to proceed with a project or

investment. The IRR rule states that if the internal rate of return (IRR) on a

project or an investment is greater than the minimum required rate of return, typically the cost

of capital, then the project or investment should be pursued. Conversely, if

the IRR on a project or investment is lower than the cost of capital, then the

best course of action may be to reject it.

Can CAGR

and IRR be Same

CAGR V/S IRR:

IRR and CAGR will be same when

1. You make a lumpsum investment (single

investment)and calculate returns for the same.

2. You make multiple investments but the annual

return is constant across years. These investments can be periodic like a SIP

or recurring fixed deposit. By the way, returns in a MF SIP are unlikely to be

constant.

CAGR V/S IRR:

IRR and CAGR will be different when

You make multiple investments and

the annual returns are variable. This will be the case with any volatile

investment such as equities.

You should not use CAGR when you

want to estimate returns for your mutual fund investments.

The Bottom Line

The CAGR

Helps frame an investment’s return over a certain period of time. It has its

benefits, but there are definite limitations that investors need to be aware

of. With multiple cash flows, the IRR or XIRR approach is usually considered to

be better than CAGR. Investors should understand how investment returns are

calculated and which return to consider for making investment decisions.

Awareness and knowledge about calculating the returns from investment is

important to be a smart investor.

Short Summary for the Difference between CAGR and XIRR

|

Particulars

|

CAGR

|

XIRR

|

|

Description

|

It is a measure of the compound

rate of growth

|

It is the average rate earned by

each and every cash flow invested during the period

|

|

Multiple

cash flows

|

It does not consider the

multiple cash flows

|

Yes, it is considered

|

|

Absolute /

Annualized measure

|

Absolute return

|

Only annualized

|

|

Timing of

cash flow

|

As cash flow are there, only

time matters is the time between the amount invested and amount redeemed. Longer

the period of holding the investment, better the CAGR.

|

It is very important. Timing

affects the returns. It gets influenced by the early cash flows. Returns

could be amplified or muted based on the timing of cash flows.

|

|

Measurement

|

Measures the performance of the

lumpsum amount invested

|

Measures of the performance of

the cash flow

|

....